unified estate and gift tax credit 2021

The unified tax credit changes regularly depending on regulations related to estate and gift taxes. Any tax due is.

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

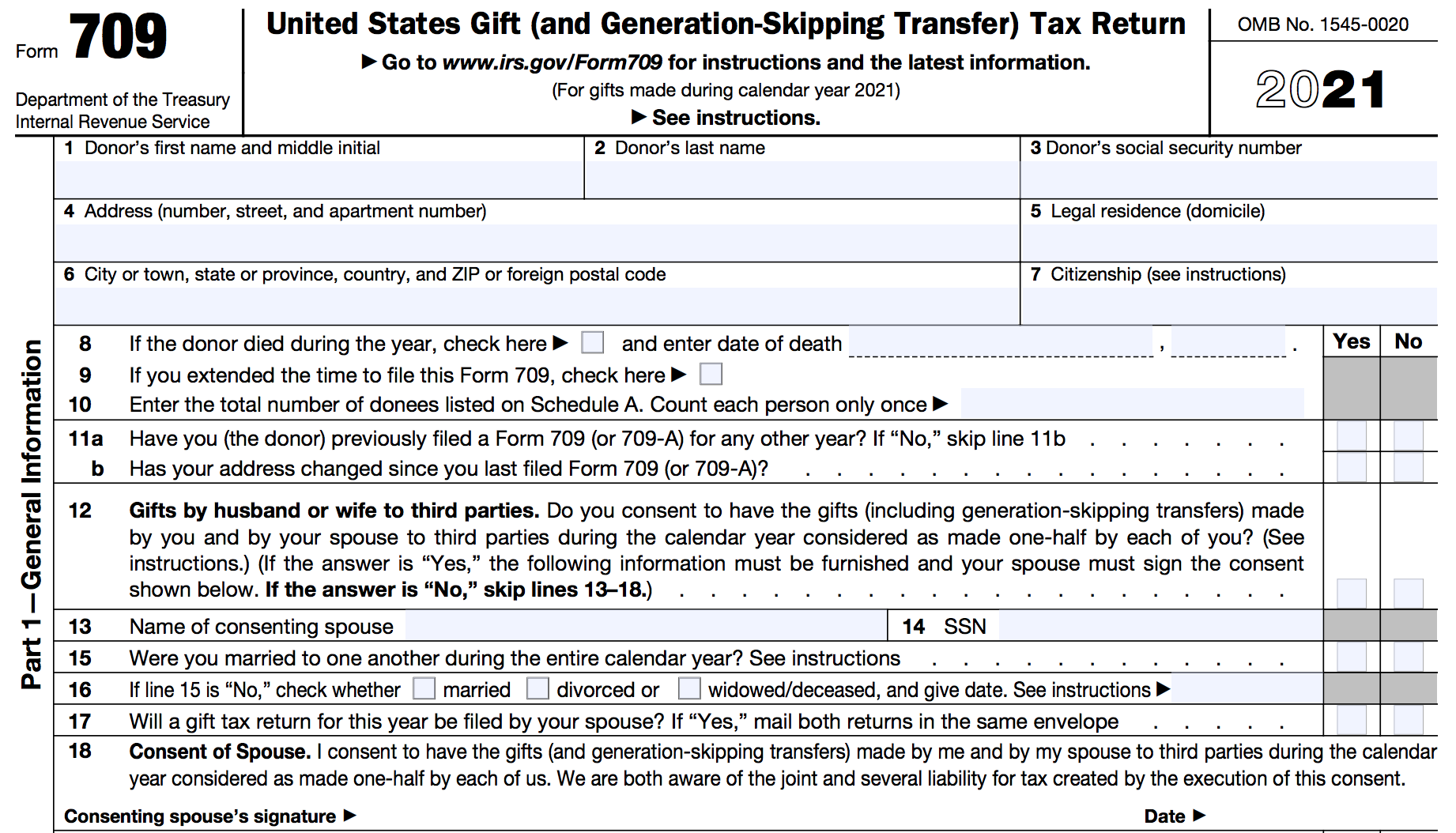

Form 709 United States Gift And Generation Skipping Transfer Tax Return

For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

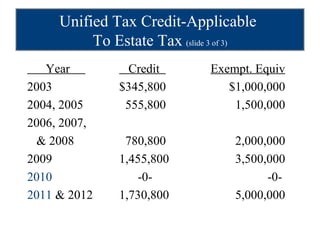

. Estate Tax Exemption Basic Exclusion Amount 11700000. What Is the Unified Tax Credit Amount for 2021. 1 day agoIn 1976 Congress unified the gift and estate tax regimes thereby limiting the givers ability to circumvent the estate tax by giving during his or her lifetime.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. For 2022 the exemption increases to 1206 for individuals and 2412 for married couples filing jointly up from 117 million and 234 million respectively for 2021. This means that when someone dies and the value of their estate.

The unified tax credit is designed to decrease the tax bill of the individual or estate. If a gift is given as a present interest gift meaning it is given outright to a person then the amount is not added into your total lifetime unified gift and estate tax credit. The Estate Tax is a tax on your right to transfer property at your death.

Gift and Estate Tax Exemptions The Unified Credit. A person giving the gifts has a lifetime exemption from. The lifetime exemption was.

Wednesday January 20 2021 The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million. This year they could give each child a combined 32000 without triggering the gift tax. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. It can be used by taxpayers before or after death integrates both the gift and estate taxes into. ESTATE AND GIFT TAXES Estate Taxes 2021 2020.

The unified tax credit changes regularly depending on regulations related to estate and gift taxes. In Revenue Procedure 2021-45 RP-2021-45 irsgov the Internal Revenue Service announced annual inflation-adjusted tax rates for 2022 including. News November 29 2021.

Unified estate tax credit 4577800 4577800 Top estate tax rate 40 40 Gift Taxes 2021 2020 Lifetime gift tax exemption. Generation-Skipping Transfer GST Tax Exemption. Gifts and estate transfers that exceed 1206 million are subject to tax.

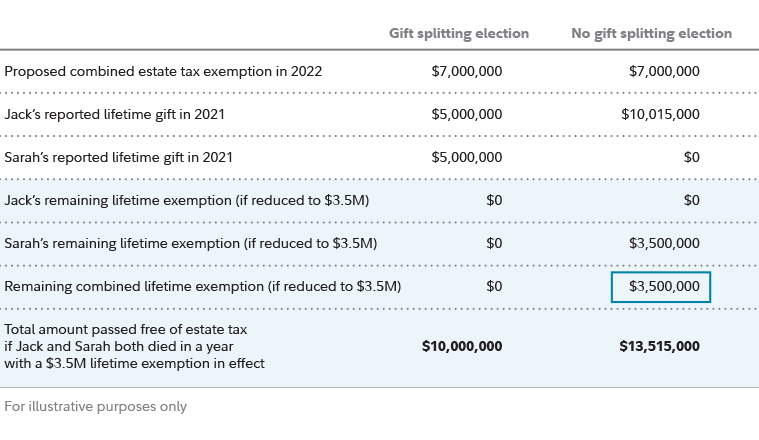

What Is the Unified Tax Credit Amount for 2021. The gift and estate tax. How Does That Affect Estate Plans says that because of this 5 million federal estate tax exemption many estate planning attorneys moved from a two-trust estate plan to.

The Unified Tax Credit represents the amount of assets that an individual is allowed to gift to other parties without having to pay gift estate or generation-skipping transfer. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of 55 to a n exemption of 1158. For 2021 the estate and gift tax exemption stands at 117 million per person.

The unified credit is per person but a married couple can combine their exemptions. December 2 2020. The 2017 Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025.

A unified tax credit can reduce or eliminate your federal tax obligation while also integrating federal gift and estate taxes into one unified tax system. The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate. This means that an individual is currently.

The gift and estate tax. Then there is the exemption for gifts and estate taxes. The previous limit for 2020 was 1158 million.

The extent of the benefit. You could either pay the gift tax on the additional 4000 over the 16000 annual exclusion or you could apply it to the unified lifetime exemption. Gifts above the 16000 per giver amount will reduce the lifetime gift and estate exemption by the.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Warshaw Burstein Llp 2022 Trust And Estates Updates

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Estate Planning Strategies For Gift Splitting Fidelity

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa

U S Estate Tax For Canadians Manulife Investment Management

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

U S Estate Tax For Canadians Manulife Investment Management

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Is That Gift Taxable Irs Form 709 John R Dundon Ii Enrolled Agent

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition